DoorDash has asked a California Superior Court judge to dismiss a lawsuit filed by Uber that accuses the food delivery company of stifling competition by intimidating restaurant owners into exclusive deals.

DoorDash argues in its motion that Uber’s claim lacks merit on all fronts. On a post on its website on Friday, DoorDash said, “the lawsuit is nothing more than a cynical and calculated scare tactic from a frustrated competitor seeking to avoid real competition. It’s disappointing behavior from a company once known for competing on the merits of its products and innovation.”

In its post, DoorDash added that it will “vigorously” defend itself, and positioned the company as one that “competes fiercely yet fairly to deliver exceptional value to merchants.”

A hearing has been set for July 11 in California Superior Court in San Francisco County.

Uber filed its lawsuit against DoorDash in February. The ride-hailing giant alleged DoorDash, which holds the largest share of the food delivery market in the U.S., threatens restaurants with multimillion-dollar penalties or the removal or demotion of the businesses’ position on the DoorDash app.

Uber responded to the DoorDash request in a statement sent to TechCrunch.

“It seems like the team at DoorDash is having a hard time understanding the content of our Complaint,” reads the emailed statement from Uber. “When restaurants are forced to choose between unfair terms or retaliation, that’s not competition — it’s coercion. Uber will continue to stand up for merchants and for a level playing field. We look forward to presenting the facts in court.”

Uber requested a jury trial in its original complaint. The company has not specified the amount of damages it is seeking.

Separately, Deliveroo confirmed Friday that DoorDash offered to buy the European food delivery company for $3.6 billion.

Keep reading the article on Tech Crunch

Welcome back to TechCrunch Mobility — your central hub for news and insights on the future of transportation. Sign up here for free — just click TechCrunch Mobility!

Busy week, so let’s get to it. Starting with federal regulations! Woohoo. Exciting stuff.

I’m talking about the U.S. Department of Transportation’s new Automated Vehicle Framework, which includes a standing general order (SGO) on crash reporting for vehicles equipped with certain advanced driver-assistance systems and automated driving systems. There were also some changes to the Automated Vehicle Exemption Program (AVEP).

Briefly, the AVEP handles language and processes of domestic and imported vehicles receiving exemptions. I want to spend a bit more time on the SGO, which has more significant changes. The Trump administration says it streamlines the process; others, like Consumer Reports, disagree.

The SGO ends a 24-hour reporting requirement and instead allows companies five days to submit a report if a vehicle with a Level 2 system is involved in a crash. As Consumer Reports notes, the new order also changes reporting requirements for when a vehicle with Level 2 driving automation has been towed away after a crash.

In the past, any vehicle with a Level 2 or above advanced driver-assistance system involved in a crash that DID NOT involve a fatality or hitting a vulnerable road user like a pedestrian or cyclist still had to report it within five days. Now the rule will only apply to vehicles with ADS (automated driving systems), which cuts out the bulk of vehicles on the road today.

That means if a Tesla that has Autopilot engaged (or a GM vehicle with Super Cruise or Ford with its BlueCruise system on) crashes and must be towed, it doesn’t need to report that to the feds as long as the incident did not involve a fatality, an individual being transported to a hospital for medical treatment, a pedestrian or other vulnerable road user being struck, or an air bag deployment.

Reporting is still required for any vehicle with Level 2 ADAS (like Tesla Autopilot) or ADS that is in a crash in which there is a fatality, an air bag is deployed, a person is transported to the hospital, or a vulnerable road user is hit.

During an interview at a Semafor event, DOT Secretary Sean Duffy seems to give a nod to those rules (although he says “autonomous” and not “ADAS”) when he said, “What we want to do is be able to get good data, but if there’s a scraping of paint off of an autonomous vehicle, the reporting requirements became very laborious and challenging, and it slowed the process down.”

Think I got this wrong? Reach out.

OK, on to the rest.

Slate, the Bezos-backed EV startup, broke cover at an event in Long Beach, California. Many of the details that senior reporter Sean O’Kane reported in his initial scoop were finally presented to the public.

Earlier in the week, we published some other insider details thanks to some little birds that describe how leaders have internally described the Slate EV as a “transformer” — as in the animated “more than meets the eye” series. Turns out, that is exactly what the company is pitching to customers.

Got a tip for us? Email Kirsten Korosec at [email protected] or my Signal at kkorosec.07, Sean O’Kane at [email protected], or Rebecca Bellan at [email protected]. Or check out these instructions to learn how to contact us.

Ather Energy, the Indian startup manufacturing electric two-wheelers, cut the size of its initial public offer by 18% to 26.26 billion Indian rupees ($308.3 million).

DoorDash wants to buy Deliveroo for $3.6 billion, Axios reported.

Electra, the hybrid electric aircraft startup, raised $115 million in a Series B round led by Prysm Capital. Jay Park, co-founder and managing partner at Prysm, has joined Electra’s board of directors.

Fora, a travel agent startup based in New York, raised $60 million across Series B and C rounds. Josh Kushner’s Thrive co-led the $40 million Series C round.

The venture arm of United Airlines has invested an undisclosed amount in JetZero, a startup developing a blended wing body design.

Alphabet CEO Sundar Pichai received some attention for remarks during the company’s earnings call about its self-driving vehicle unit Waymo. In response to a question, he said, as part of a longer answer, “There’s future optionality around personal ownership as well.”

Waymo has talked vaguely about licensing its tech (presumably to automakers) before, so I wouldn’t read too much into this. But it’s certainly notable that Pichai said it in an earnings call.

Tesla has started testing its autonomous ride-hail service with employees in Austin and the Bay Area ahead of the company’s planned robotaxi launch this summer.

Volkswagen of America and Uber plan to launch a commercial robotaxi service — using autonomous electric VW ID. BUZZ vehicles — in multiple U.S. cities over the next decade.

The companies expect to launch a commercial service in Los Angeles by late 2026, although it will initially include human safety drivers. The news brought me back to 2017-18 — an era of partnership announcements, many of which never materialized. VW has a lot of work to do before it launches commercially, including gaining even the most basic testing permit.

Aidan Gomez, the co-founder and CEO of generative AI startup Cohere, joined Rivian’s board. I don’t want to read too deeply into the appointment, but it does signal Rivian’s interest in applying AI to its own venture while positioning itself as a software leader — and even provider — within the automotive industry.

Faraday Future somehow still exists and its board has appointed founder Jia Yueting as the company’s co-CEO, three years after he was sidelined following an internal probe into allegations of fraud. Side note: A Securities and Exchange Commission investigation remains ongoing.

Tesla earnings supported a hypothesis I’ve had cooking in my brain for a while now. The company exists in contradictory realities. In one, Tesla’s profits are down 71% YoY, automotive revenues continue to fall, and its energy business is exposed to the U.S.-China trade war. In the other, Tesla is really an AI company that finally has the attention of its CEO Elon Musk and is on the cusp of launching an autonomous vehicle ride-hailing service and a cheaper EV — although it has yet to do either.

Investors grabbed on to the Tesla-is-an-innovator reality with both hands and they really don’t want to let go — even if the reality is that anti-Musk sentiment is affecting the brand and is even an official risk in its regulatory filing. Musk’s comments about allocating more time to Tesla and less at DOGE helped push them there. If you want to catch up on all the nuggets in the earnings report and call, scroll through our Tesla earnings wrap-up.

The Federal Trade Commission filed a lawsuit against Uber, alleging the company charged customers for its Uber One subscription service without their consent.

What is Lyft’s loss is Uber’s gain. Delta SkyMiles members in the United States can now start earning points when they ride with Uber or order delivery through Uber Eats as part of a recently announced exclusive partnership between the two companies. (Lyft had a partnership with Delta.)

Keep reading the article on Tech Crunch

Slate Auto, the buzzy new EV startup that broke stealth this week, is close to locking in a former printing plant located in Warsaw, Indiana as the future production site for its cheap electric truck, a review of public records shows.

The company is expected to lease the 1.4 million-square-foot facility for an undisclosed sum. Economic development officials told local media earlier this year (without naming Slate) the factory could employ up to 2,000 people, and that the county offered the undisclosed company an incentive package.

It’s not immediately clear what that incentive package includes or if it has been finalized. Slate did not immediately respond to a request for comment. Peggy Friday, the CEO of the Kosciusko County Economic Development Corporation said in an email that she is “under a strict non-disclosure agreement with the project.”

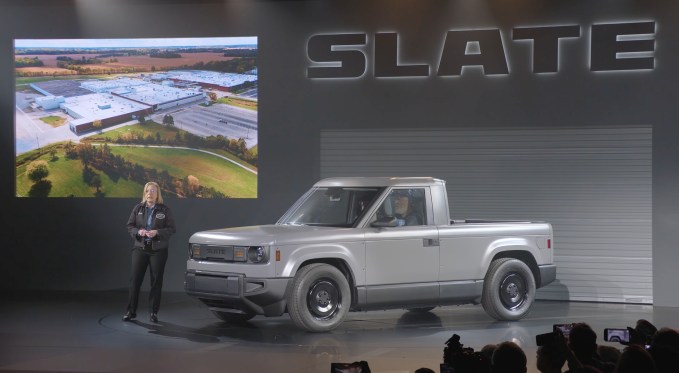

Slate showed an aerial photo of the factory during Thursday’s event. The company did not say where it was located, but the photo matches a public listing for the facility available on the Indiana Economic Development Corporation’s website. TechCrunch previously reported that the company planned to make its EVs, which will cost under $20,000 after the federal tax credit, in Indiana.

“Our truck will be made here in the USA as part of our commitment to re-industrializing America,” Slate’s CEO Chris Barman said onstage while the factory photo was displayed on a screen behind her.

Slate’s focus on domestic manufacturing is embedded in the company’s DNA. The startup was originally created inside of Re:Build Manufacturing, a Massachusetts-based company focused on beefing up the country’s ability to make things.

The factory in Warsaw was built in 1958, and was occupied for decades by printing company R.R. Donnelly. It has been dormant for around two years, according to local media.

Converting a factory, especially one that was not previously pumping out cars, is no cheap or easy task. Slate has amassed a serious war chest to help tackle that goal. Backed in part by Amazon founder Jeff Bezos, Guggenheim Partners CEO Mark Walter, and powerhouse VC firm General Catalyst, the startup has raised well over $100 million to date.

The approach Slate is taking in designing and building its electric truck should help keep costs down, too. The company plans to sell wraps for the trucks instead of painting them, meaning it does not need to build a paint shop at the factory. That alone could save Slate hundreds of millions in the plant buildout process.

Keep reading the article on Tech Crunch

A new American electric vehicle startup called Slate Auto has made its debut, and it’s about as anti-Tesla as it gets.

It’s affordable, deeply customizable, and very analog. It has manual windows and it doesn’t come with a main infotainment screen. Heck, it isn’t even painted. It can also transform from a two-seater pickup to a five-seater SUV.

The three-year-old startup revealed its vehicle during an event Thursday night in Long Beach, California, and promised the first trucks would be available to customers for under $20,000 with the federal EV tax credit by the end of 2026.

The event comes just a few weeks since TechCrunch revealed details of Slate Auto’s plans to enter the U.S. EV market, build its trucks in Indiana, and that the enterprise is financially backed by Amazon founder Jeff Bezos.

The auto industry “has been so focused on autonomy and technology in the vehicle, it’s driven prices to a place that most Americans simply can’t afford,” chief commercial officer Jeremy Snyder said during the event, which Inside EVs live streamed. “But we’re here to change that.”

“We are building the affordable vehicle that has long been promised but never been delivered,” CEO Chris Barman added.

Slate isn’t saying exactly how much its truck will cost — multiple sources have told TechCrunch over the last few weeks the company has gone back and forth on the number. And so much can change between now and a late 2026 release date.

The company is saying it will start under $20,000 after the federal tax credit (providing that still exists next year). Interested buyers can place a $50 refundable reservation on the company’s website.

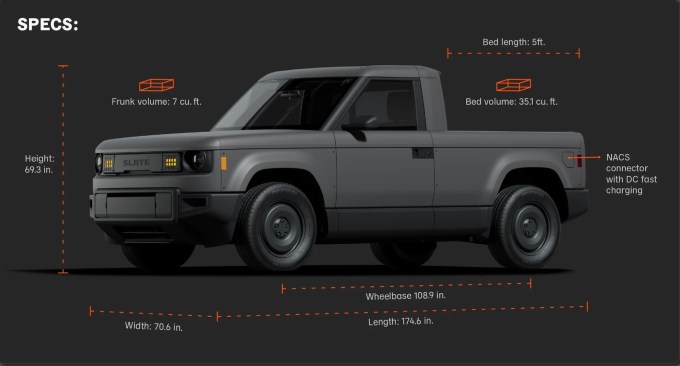

The base version of Slate’s truck will squeeze 150 miles out of a 52.7kWh battery pack, which will power a single 150kW motor on the rear axle. For folks who get a little spooked at that number, Slate is offering a larger battery pack that it says will have about 240 miles of range. It will charge using a North American Charging Standard port, the standard Tesla established that almost all major automakers now use.

The truck comes with 17-inch wheels and a five-foot bed, and has a projected 1,400 pound payload capacity with a 1,000 pound towing capacity. Since it’s an EV, there’s no engine up front. In its place there’s a front trunk (or frunk) with 7 cubic feet of storage space, which happens to have a drain in case the owner wants to fill it with ice for that tailgate party.

That towing capacity is lower than a more capable Ford F-150, and is even less than the smaller Ford Maverick, which can tow around 1,500 pounds.

Speaking of the Ford Maverick, Slate’s truck is smaller. The Slate EV has a wheelbase of 108.9 inches, and an overall length of 174.6 inches. The Maverick has a 121.1-inch wheelbase and overall length of 199.7 inches

Everything else about the base version of the truck is awfully spare — and that’s the point. Slate is really maximizing the idea of a base model, and setting customers up for paying to customize the EV to their liking.

Slate is deeply committed to the idea of customization, which sets it apart from any other EV startup (or traditional automaker).

The company said Thursday it will launch with more than 100 different accessories that buyers can use to personalize the truck to their liking. If that’s overwhelming, Slate has curated a number of different “starter packs” that interested buyers can choose from.

The truck doesn’t even come painted. Slate is instead playing up the idea of wrapping its vehicles, something executives said they will sell in kits. Buyers can either have Slate do that work for them, or put the wraps on themselves.

This not only adds to the idea of a buyer being able to personalize their vehicle, but it also cuts out a huge cost center for the company. It means Slate won’t need a paint shop at its factory, allowing it to spend less to get to market, while also avoiding one of the most heavily regulated parts of vehicle manufacturing.

Slate is telling customers that they can name the car whatever they want, offering the ability to purchase an embossed wrap for the tailgate. Otherwise, the truck is just referred to as the “Blank Slate.”

As TechCrunch previously reported, the customization piece is central to how the company hopes to make up margin on what is otherwise a relatively dirt-cheap vehicle.

But it’s also part of the friendly pitch Slate is making to customers.

Barman said Thursday that people can “make the Blank Slate yours at the time of purchase, or as your needs and finances change over time.” It’s billing the add-ons as “easy DIY” that “non-gearheads” can tackle, and says it will launch a suite of how-to resources under the billing of Slate University.

“Buy your accessories, get them delivered fast, and install them yourself with the easy how-to videos in Slate U, our content hub,” the website reads. “Don’t want to go the DIY route? A Slate authorized partner can come and do it for you.”

The early library of customizations on Slate’s website range from functional to cosmetic. Buyers can add infotainment screens, speakers, roof racks, light covers, and much more.

The most significant are the options that let buyers “transform” the truck into roomier SUV form factors. But these aren’t permanent decisions. Slate says people will be able to change their vehicle into, and back from, an SUV if they like — “no mechanics certification required.”

All that said, Slate’s truck comes standard with some federally mandated safety features such as automatic emergency braking, airbags, and a backup camera.

The road to making a successful American automotive startup is littered with failures. In the last few years, Canoo, Fisker, and Lordstown Motors have all filed for bankruptcy. And that’s just to name a few. Those companies that are still around, like Rivian and Lucid Motors, are hemorrhaging money in an attempt to get high-volume, more affordable models to market.

Slate is a total inversion of that approach. It’s going after a low-cost EV first and foremost, and hopes to make that business viable by supplementing it with money from this deep customization play.

But, much like Rivian and Lucid Motors, it also has deep-pocketed backers. It raised has raised more than $111 million so far (the exact figure is still not public). And, aside from Bezos, has taken money from Mark Walter, Guggenheim Partners CEO and controlling owner of the LA Dodgers, as TechCrunch reported this month.

The company has hired nearly 400 employees in service of accomplishing all of its ambitious goals, and is currently trying to hire more. Slate arguably could not have picked a more volatile time to make its debut, but it’s also focused on domestic manufacturing, and may be insulated from some of the turmoil facing other startups and established automakers.

“We believe vehicles should be affordable and desirable,” Barman said Thursday, adding that Slate’s truck “is a vehicle people are actually going to love and be proud to own.”

Keep reading the article on Tech Crunch

Troubled electric vehicle startup Faraday Future’s board of directors has appointed founder Jia Yueting as the company’s co-CEO, three years after he was sidelined following an internal probe into allegations of fraud — a probe that led to a investigation by the Securities and Exchange Commission that remains ongoing.

Jia will serve alongside current CEO Matthias Aydt and will oversee Faraday’s finance, legal, and supply chain teams, the company announced in a press conference Thursday. Aydt is a longtime Faraday Future employee who was once placed on probation after he offered to pay a Faraday Future board member up to $700,000 to resign in the middle of a months-long power struggle over the company.

Jia’s appointment comes just one month after Faraday Future named Jia’s nephew Jerry Wang as president of the EV startup. Wang resigned in 2022 as a result of the internal probe because of a “failure to cooperate with the investigation” according to filings with the Securities and Exchange Commission.

Faraday Future was founded by Jia in 2014 as he looked to build on what was at the time a successful electronics and media streaming empire in China.

That empire collapsed, and Jia self-exiled to the U.S. to focus on Faraday Future. The company has spent the last decade and over $3 billion to develop an ultra-luxury EV called the FF91. But it has only sold around a dozen of them to date, and has been accused in lawsuits of misrepresenting some of those sales.

Keep reading the article on Tech Crunch

The internal document from the Department of Justice was uploaded and quickly removed.