China’s Geely Auto wants to take its luxury EV unit Zeekr off the New York Stock Exchange one year after the company’s debut, per Zeekr filings.

The take-private offer comes as the Trump administration explores kicking Chinese companies off American stock exchanges, part of a broader trade war that includes what has become a tariff quagmire between the U.S. and China.

On Tuesday, Geely offered to pay $25.66 per Zeekr American Depository Receipt (ADS), or $2.566 per ordinary share, which was about 14% higher than Zeekr’s Monday afternoon closing price, in a deal that values the company at $6.5 billion. ADS holders can also opt to receive 12.3 newly issued Geely shares per ADS.

Aside from skirting potential geopolitical awkwardness, Geely has a lot to gain from taking Zeekr private and not much to lose. Geely already owns 65.7% of Zeekr through its founder Li Shufu. That means Geely would only need to pay out roughly $2.2 billion to acquire the rest. For that price, Geely could help Zeekr absorb the market blows that come with being an EV startup in a competitive market and protect its investment.

Zeekr has yet to report first-quarter results, but the company delivered a total of 125,250 vehicles across its two brands — Zeekr and Lynk & Co — in the first four months of 2025.

Zeekr is working with autonomous vehicle company Waymo to build a purpose-built robotaxi for large-scale deployment in the U.S. Neither company has confirmed if it would affect their working relationship if Geely were to take the company private, though Waymo earlier this week shared plans to integrate its self-driving system into the Zeekr vehicle at its new Arizona facility later this year.

Keep reading the article on Tech Crunch

Tesla’s attempt to trademark the term “Robotaxi” in reference to its vehicles has been refused by the U.S. Patent and Trademark Office for being too generic, according to a new filing. Another application by Tesla to trademark the term “Robotaxi” for its upcoming ride-hailing service is still under examination by the office.

In addition, applications from Tesla for the trademark on the term “Cybercab” have been halted due to other companies pursuing similar “Cyber” trademarks. That includes one company that has applied for numerous trademarks related to aftermarket Cybertruck accessories.

The USPTO issued Tuesday what’s known as a “nonfinal office action” on the “Robotaxi” trademark application, which means Tesla has three months to file a response or the office will abandon the application. A trademark lawyer representing Tesla did not immediately respond to a request for comment.

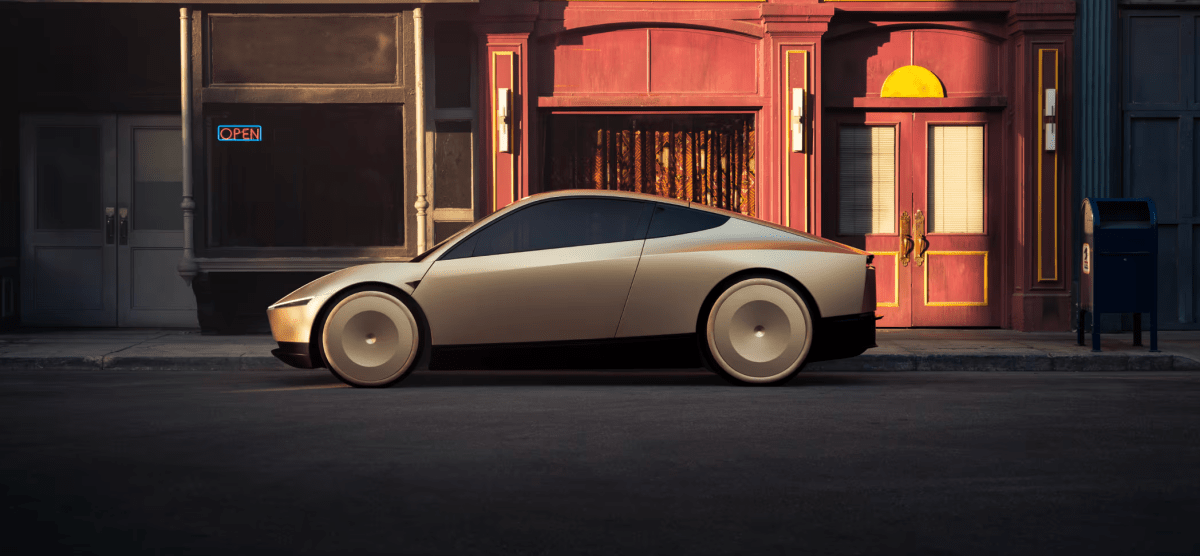

Tesla applied for the trademarks in October 2024 on the same day that it revealed the Cybercab, the purpose-built electric car that it hopes to one day use in its planned autonomous ride-hailing service. Tesla also submitted two similar trademark applications October 10 for the term “Robobus,” which are still under examination.

The trademark that was refused was assigned to a USPTO examiner on April 14. Tesla said it would use the word in reference to “[l]and vehicles; electric vehicles, namely automobiles; automobiles; and structural parts therefor,” according to the original application.

While the USPTO examiner found there were no conflicting trademarks in existence, it refused the application because it was “merely descriptive.” The examiner wrote that the term “Robotaxi” is “used to describe similar goods and services by other companies.”

“[S]uch wording appears to be generic in the context of applicant’s goods and/or services,” the examiner wrote.

Techcrunch event

Berkeley, CA

|

June 5

Tesla will be allowed to submit evidence and arguments to support its argument in favor of the trademark. If it does, the USPTO wants Tesla to provide “[f]act sheets, instruction manuals, brochures, advertisements and pertinent screenshots of applicant’s website as it relates to the goods and/or services in the application, including any materials using the terms in the applied-for mark.”

In other words, Tesla needs to give the agency specific plans for how and why it deserves the “Robotaxi” trademark.

The examiner also wrote that Tesla will need to tell the USPTO if “competitors” use the terms “ROBO, ROBOT, or ROBOTIC to advertise similar goods and/or services.”

Tesla’s other application for the “Robotaxi” trademark would cover the use of the word when offering transportation services, including “coordinating travel arrangements for individuals and for groups,” “arranging time-based ridesharing services,” and offering vehicle sharing or rentals. That application was also assigned to a USPTO examiner on April 14, but no decision has been filed.

This story has been updated to include information about the “Cybercab” trademark applications.

Keep reading the article on Tech Crunch