The Chinese e-commerce marketplace app DHgate, which is now the No. 2 free iPhone app in the U.S., isn’t the only one that’s oddly benefiting from President Trump’s tariffs on U.S. imports from China. Another Chinese shopping app, Taobao, has now also entered the Top 5 as of Thursday.

U.S. consumers began flocking to these apps over the past several days in the wake of numerous TikTok videos from Chinese manufacturers explaining how much of the luxury goods market operates out of China. The videos claim that many products from top luxury brands — like clothing, handbags, shoes, and accessories — are actually originally made in China. The items are then shipped over to the brand’s home country, like Italy or France, where they’re repackaged after the brand’s label is applied, according to these videos.

Other U.S. and Chinese TikTok creators then pointed to e-commerce apps like DHGate and Taobao as a way to buy directly from the Chinese manufacturers, forgoing the huge markup the luxury brands charge.

Already wary of the increasing prices on popular apps like Shein and Temu, U.S. consumers quickly began downloading these alternatives.

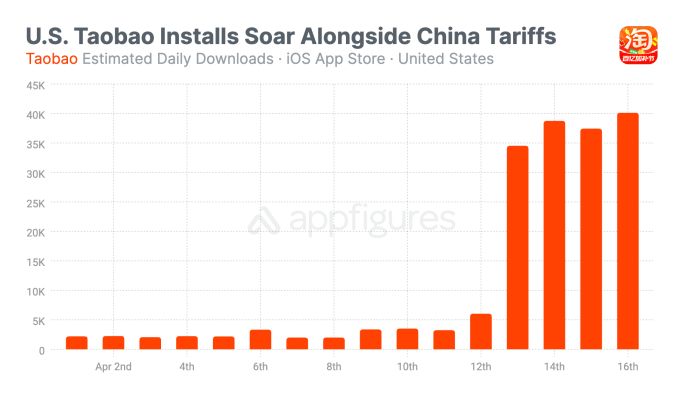

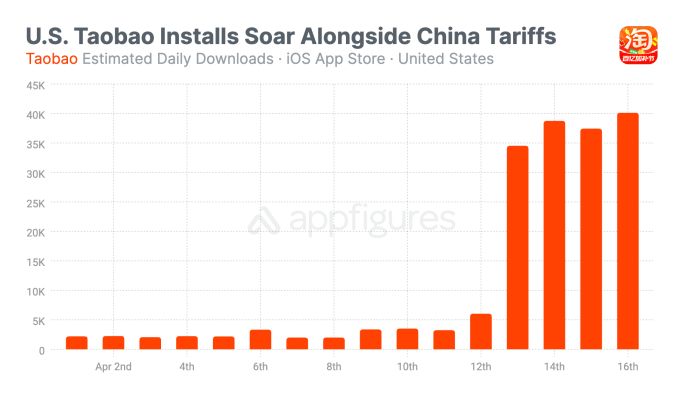

In April, Taobao’s estimated downloads totaled approximately 185,000 — a 514% increase from the 30,000 it saw during the same period last month, according to new data from app intelligence provider Appfigures. As with DHgate, Taobao’s downloads surged over this past weekend, with installs increasing 5.7x between last Friday and Saturday, the firm said.

On Saturday, Taobao entered the Top Overall ranks on the iOS App Store (excluding games) at No. 461. By Sunday, it was No. 188. And by Thursday, it reached No. 5.

The change in rank represents the growth in app installs as well as their velocity and other factors.

Taobao also grew from the No. 49 Shopping app on Saturday to become the No. 2 app, topping Walmart, Amazon, Shein, and Temu. (Chinese app Alibaba.com is also climbing the charts here, now the No. 6 shopping app on the U.S. App Store.)

Notably, Appfigures says that Taobao has never been in the Top Overall charts on the U.S. App Store according to its data, which goes back to January 1, 2017.

While switching shopping apps won’t actually save U.S. consumers from tariffs on Chinese imports, shoppers likely think buying direct from manufacturers could potentially lower the overall cost of their purchases. For other consumers, it’s simply a way to seek out luxury-style goods or dupes at a better price.

Of course, it’s still a case of “buyer beware” on any of these marketplaces, where quality can be hit or miss. Users are encouraged to read the individual sellers’ reviews and view other buyers’ photos of the items before making purchases.

Keep reading the article on Tech Crunch

Temu and Shein plan to raise prices for U.S. customers starting next week on April 25th, due to President Donald Trump’s tariffs on goods shipped from China, the Associated Press reports.

The 145% tariff on products made in China, along with Trump’s decision to end a customs exemption that had allowed goods under $800 to enter the U.S. duty-free, has disrupted the business models of both platforms. The report says nearly 4 million parcels, most of them from China, enter the U.S. every day under this soon-to-be-ended exemption.

Shein and Temu have gained significant popularity in the U.S. over the past few years due to the platforms’ discount pricing and influencer advertising.

The Wall Street Journal reported last year that Amazon now sees Shein and Temu as bigger threats to its business than retailers like Walmart and Target. In November, Amazon launched Amazon Haul, a storefront that offers mass-produced and discounted items to take on Shein and Temu.

Shein and Temu are encouraging customers to continue shopping. The companies say they will ensure orders arrive on time and are doing what they can to minimize the impact on shoppers.

Keep reading the article on Tech Crunch